COVID-19 Stimulus Legislation

Find an eligible lender near you

Here’s a side-by-side comparison of EIDL loans VS Paycheck Protection Program (PPP)

Here’s how the bill can help you now. We highlight the details of the Paycheck Protection Program, Emergency Economic Injury Disaster (EIDL) Loans, Subsidies for Loan Payments, Assistance for Workers, Families and Business and More.

We peel back the layers and talk through what’s in the bill.

The bill will provide direct payments to most Americans, provide tax breaks and loans to corporations and provide additional funds to combat the Coronavirus.

COVID-19 Stimulus Legislation (Phase 2)

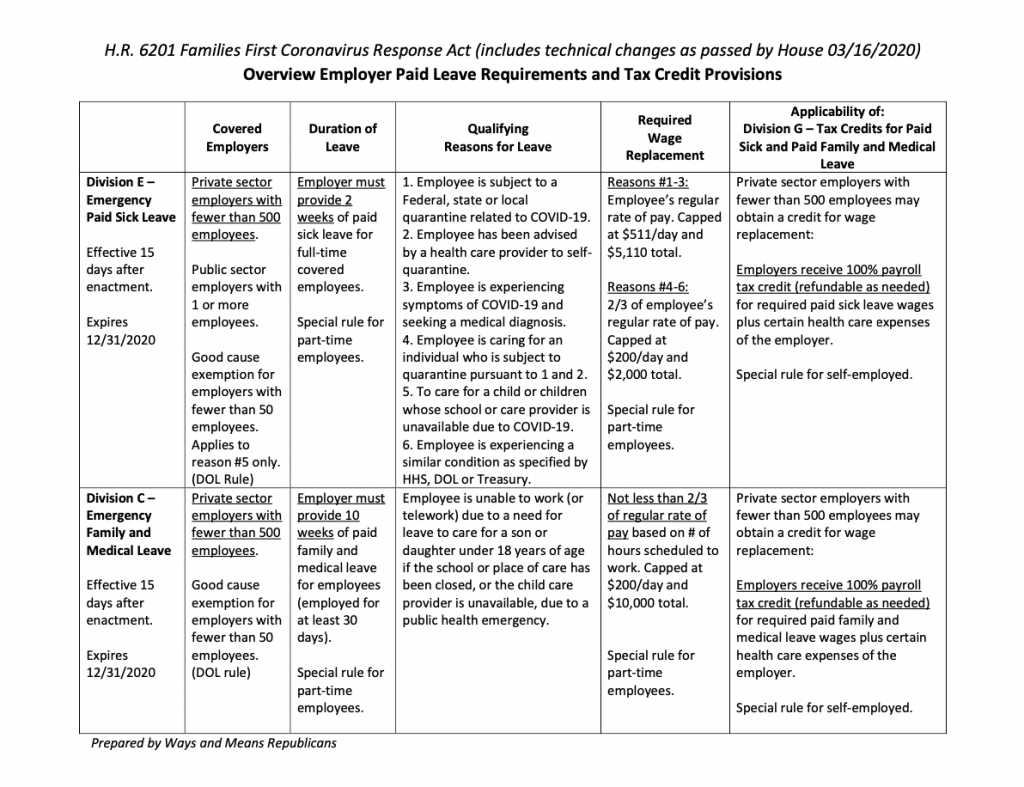

Congress passed legislation on March 18, 2020, which was immediately signed by President Trump. This stimulus builds on the first stimulus bill of $8.5 billion passed in early March and provides numerous employee benefits including:

• Establish a federal emergency paid leave benefits program to provide payments to employees taking unpaid leave due to the coronavirus outbreak

• Private sector employers with fewer than 500 employees must provide 10 weeks of paid family and medical leave for employees who are unable to work or telework due to a need for leave to care for a child because of school or daycare closing.

• The payment is capped at $200/day and $10,000 total.

• Employers may receive 100% payroll tax credit for required paid leave for employees plus health care expenses of the employer.

• Require employers to provide paid sick leave to employees

•Private sector employers with fewer than 500 employees must provide 2 weeks of paid sick leave for full-time employees if the employee meets the qualifying reasons for leave (described in the matrix below).

• Employers may obtain a credit for wage replacement of required paid sick leave wages

• Expand unemployment benefits and provide grants to states for processing and paying claims

• Unemployment benefits for laid-off workers are extended to 26 weeks in most state and an additional 13 to 20 weeks may be added for workers in states with rising unemployment rates.

• Provide self-employed tax credit

• Self-employed individuals may receive a credit against the tax imposed for net earnings up to 100% of the individual’s time taken for sick-leave or 67% if taken for the care of a sick family member with a cap up to $511 per day under certain circumstances.

• Other Provisions included in the Phase 2 bill include:

• Establish requirements for providing coronavirus diagnostic testing at no cost to consumers,

• Treat personal respiratory protective devices as covered countermeasures that are eligible for certain liability protections, and

• Temporarily increase the Medicaid federal medical assistance percentage (FMAP)