Paycheck Protection Program Launches Application Process Today

Today, millions of small business owners can apply for government-backed Paycheck Protection Program loans that will let them pay their employees throughout Coronavirus containment measures.

Jobless claims surged last week, setting national records and highlighting the need for small businesses to have access to more resources for keeping employees on payroll.

For loan comparisons and a breakdown of the Paycheck Protection Program (PPP) — which promises small businesses up to 2.5 times their total monthly payroll (with a maximum of $10 million) and an interest rate of 1% —check out our COVID-19 Resource Center.

“One of the things I’ve heard is this small business program is going to be so popular that we’re going to run out of our $350 billion,” Treasury Secretary Steven Mnuchin told CNBC this week. “If that’s the case, I can assure you that will be top of the list for me to go back to Congress on. It has huge bipartisan support and we want to protect small business.”

Some large banks, like JP Morgan, have reported they will likely not be ready to start taking applications today. Others are considering not participating, because they would be expected to hand out loans quickly – within days – which could open them up to legal risk.

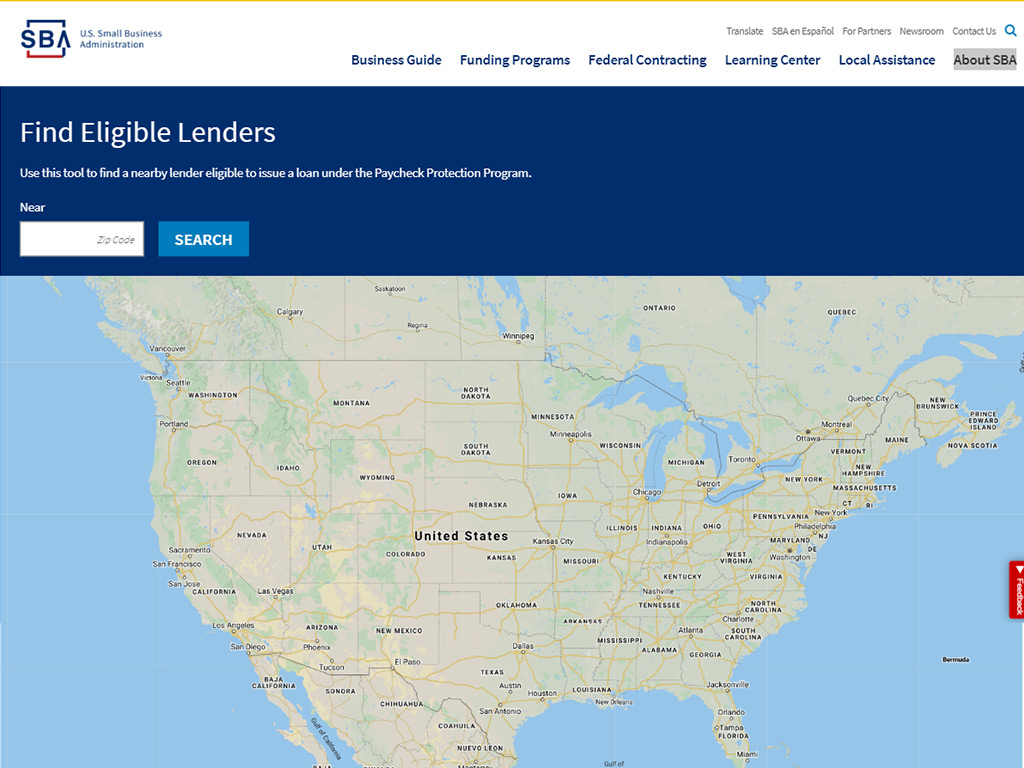

https://www.sba.gov/paycheckprotection/find

We at ESA want to hear from you. How are you faring with your application today? Are local banks working with you? Contact Steven.Calhoun@ESAweb.org to share your story.