State of the Industry

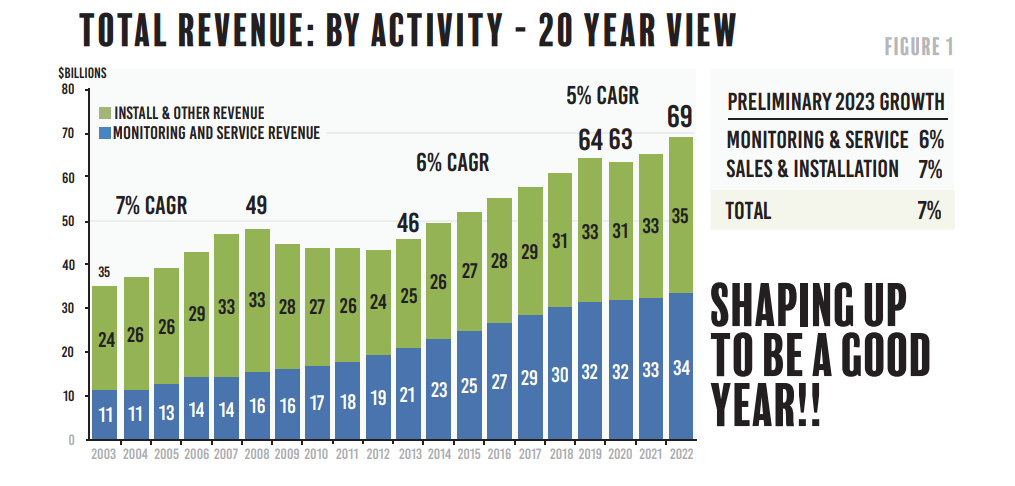

Michael Barnes, President of Barnes Associates Inc., joined ESA’s 2023 Virtual Town Hall Meeting in November to share his insights into the state of the industry and its trends. Looking at a 20-year view, it’s evident the industry’s growth has remained consistent, except for a blip on the chart during 2020, at the height of COVID19. Despite that blip, 2023 is nearly back to the same pre-COVID growth rates, much to the surprise of many who track the industry.

Industry Growth

In 2023, the industry saw a growth of 6% across all Monitoring and Service categories and a growth of 7% across Sales and

Installation. In fact, the compounded rate of growth post-Covid is at 5%– only 1% lower than the consistent 6% compounded growth in the 7 years prior to the pandemic. (See figure 1)

More specifically, 2022 Saw the following growth across various areas of the industry:

Smart Home 15%+

Pers 15%+

DIY 15%+

Video Surveillance 14%+

Larger commercial growth 10%+

Traditional Residential & SMB 3%+

These metrics show that specialty segments are growing significantly, and the industry is generally consolidating as it continues to grow.

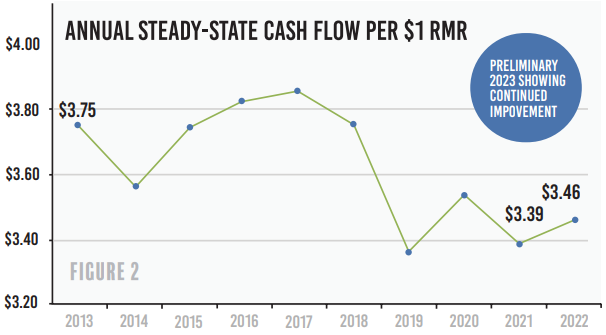

Cash Flow on RMR

Additionally, cash flow per $1 RMR is experiencing steady growth post 2020, with predictions indicating that this trend will continue through the end of 2023 and beginning of 2024.

Attrition

Trends over the past three years have also seen an improvement in attrition rates for the industry particularly in 2023. Given the wild overturn many industries were seeing in the pandemic world, this positive change is a breath of fresh air.

Potential Threats

In the face of positive news and growth, it’s critical to keep in mind a few potential threats that could affect businesses. The cost to obtain or originate new customers had been continuously increasing for years but has seen improvement throughout 2022 and 2023. And while the market remains competitive, it has also seen some positive changes, including decreases in discounting. Furthermore, attrition rates have fallen, making for a more stable workforce across the industry. All of these indicators show positive overall performance– a surprising but welcome pattern for the industry.

However, despite– or perhaps, because of these positive metrics and significant growth, it’s important to keep in mind a few threats that could cause potential risk for our industry businesses.

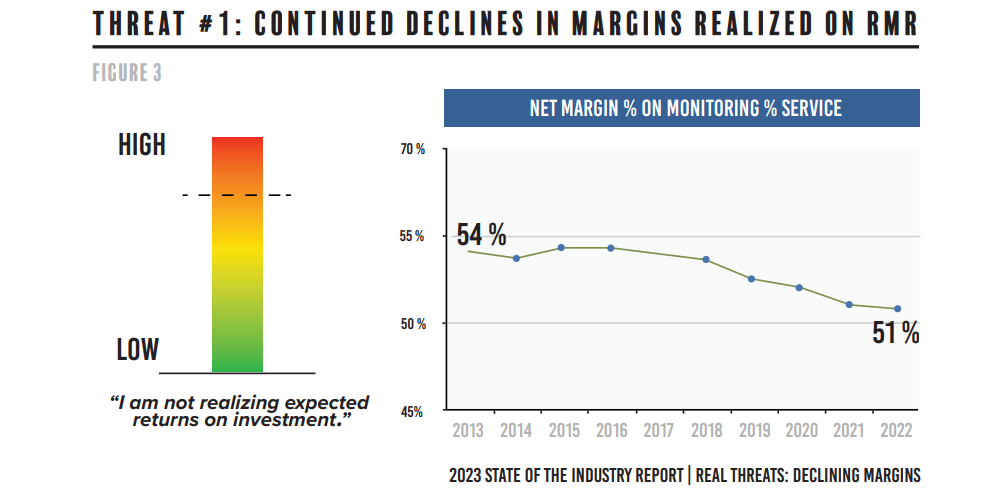

Threat 1: Declining Margins

The first threat lies in declining margins, (see Figure 3)

While many believe that industry growth, sophistication, and consolidation should result in margin growth, that’s unfortunately just not accurate.

It seems one of the biggest contributors to the decrease in margins is the continuous addition of new services on top of core monitoring that come in with lower margins. While this is not necessarily a negative thing, it’s certainly something to be aware of and take into consideration where margins are concerned.

However, since cash flow per $1 of RMR and attrition rates are improving, industry businesses should be able to handle the impact of

shrinking margins if they gauge their projections and models carefully. Currently many model their growth by assuming it will come in at a margin consistent with or higher than their RMR. Barnes foresees these projections and models’ accuracy may be impacted by the margin decline the industry is experiencing.

Threat 2: Inflation

A second threat to keep in mind lies in inflation. During the Covid19 pandemic, the government helicopter sprayed billions of dollars into the US economy, which only exacerbated an issue that already existed in the pre-Covid world. And the truth is, inflation is not going anywhere. (see figure 4)

The only way to stay ahead of this threat is by raising service prices to help cover your costs.

“It’s completely normal for the customer to absorb this impact,” says Barnes. “And it’s important for you to remember that your services are essential and necessary.”

As such, it’s important for businesses in the industry to monitor the economy and charge what they need to avoid undercutting themselves and damaging their business.

Threat 3: Operating Complexity

The third major threat to industry businesses, according to Barnes, is Operating Complexity. (See figure 5)

Technology evolves faster by the day, impacting the way the security industry operates from suppliers up through installers and technicians and even management. It’s critical to keep a finger on the pulse of the consistent changes happening to ensure that businesses can keep up with it and make relevant changes to their offerings, training and certifications, and general business operations.

The Bottom Line

The bottom line is that 2 of the 3 major operating metrics have improved and continue to improve through 2023 and the beginning of 2024: cost and attrition, so decreasing margins should not cause any major impact on the industry. Additionally, industry growth shows no sign of waning even after 20 years of mostly consistent improvement. The fact that the industry bounced back so robustly post-Covid is a certain signpost of this.

All of that said, it is important to keep in mind that the market is cyclical, and it is probable that it peaked in late 2022 or early 2023 and may experience somewhat of a holding pattern or even a minor decline. Given the positive metrics seen in past years, however, it should not be alarming. It is simply part of the process, but overall, the industry is healthy and thriving. That is certainly much to be grateful for.